What Is APR and Why It Matters When Buying a Car

When buying a car, one of the most important factors to consider is the Annual Percentage Rate (APR). APR is a term you’ll frequently encounter when discussing car financing, loans, and leases. It’s crucial to understand what APR represents and how it can affect your overall vehicle purchase.

In this blog post, we’ll break down what APR is, how it works, and why it’s important to pay attention to it when buying a car.

What is APR?

APR, or Annual Percentage Rate, is a percentage that represents the total cost of borrowing money expressed on an annual basis. It’s a critical figure to understand when it comes to financing a vehicle, as it reflects both the interest rate charged by the lender and any additional fees associated with the loan. APR gives you a clearer picture of the actual cost of your car loan over time, beyond just the monthly payment.

How Does APR Work?

- Interest Rate vs. APR: The interest rate on a car loan is the cost charged by the lender to borrow the money. It’s expressed as a percentage of the loan amount. The APR, however, includes not only the interest rate but also any additional fees, such as origination fees, closing costs, or points. This makes the APR a more comprehensive representation of the total cost of the loan.

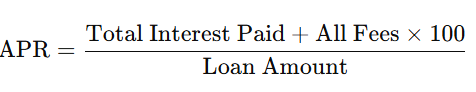

- Calculating APR: To calculate the APR, lenders use the following formula:

This formula takes into account not only the interest charged on the loan but also any upfront fees or closing costs. The APR is expressed as a yearly percentage, allowing buyers to easily compare the true cost of different loans over time.

- Factors Affecting APR:

- Credit Score: Your credit score is one of the most significant factors influencing your APR. The higher your credit score, the better the interest rate you’re likely to receive. Lenders use your credit score to assess your creditworthiness and ability to repay the loan.

- Loan Term: The length of the loan term also affects the APR. Generally, shorter loan terms result in a lower APR because lenders charge less interest over a shorter period. However, monthly payments may be higher.

- Down Payment: A larger down payment can reduce the APR. By reducing the loan amount, you lower the risk for the lender, which can lead to a better rate.

- Type of Loan: The type of loan—whether it’s new or used, secured or unsecured—also influences the APR. Secured loans, where the vehicle is used as collateral, usually offer lower APRs.

Why APR Matters When Buying a Car

Understanding the APR is crucial for several reasons:

- Total Cost of the Loan: The APR gives you a clearer picture of the overall cost of the loan beyond the monthly payment. It includes both interest and fees, so you know exactly how much you’re paying over the life of the loan. This helps you avoid surprises and plan your budget more effectively.

- Comparison Shopping: APR allows you to compare loan offers from different lenders and dealerships. Even if a loan has a lower interest rate, it might include high fees that push up the APR. By comparing APRs, you can choose the loan with the best overall value.

- Negotiating Power: Knowing the APR puts you in a stronger position when negotiating with lenders and dealerships. If you have a good credit score, you can negotiate for a lower APR. If your credit isn’t as strong, understanding your options helps you shop around for the best deal.

- Building Credit: A car loan can also be a way to build or rebuild your credit. By consistently making on-time payments, you can improve your credit score, potentially lowering your APR for future loans.

- Impact on Monthly Payments: The APR directly affects your monthly payments. A lower APR means lower interest costs over time, which can reduce your monthly payments and make the loan more affordable. This can also free up your budget for other financial priorities.

How to Find the Best APR for Your Car Loan

Finding the best APR involves some research and strategic planning. Here’s how you can ensure you get the best rate possible:

- Check Your Credit Score: Before you start shopping for a car loan, check your credit report. Knowing your credit score gives you an idea of the APR you might qualify for. If your score is low, consider taking steps to improve it before applying for a loan.

- Shop Around: Don’t settle for the first loan offer you receive. Visit different lenders, including banks, credit unions, and online lenders. Compare the APRs they offer and ask about any fees that might be included.

- Consider Your Down Payment: A larger down payment reduces the amount you need to borrow, which can lower your APR. If possible, save up for a substantial down payment before purchasing a vehicle.

- Negotiate with the Dealer: If you’re buying from a dealer, they often have relationships with lenders that can offer lower APRs. Don’t be afraid to negotiate for a better rate or ask for additional discounts.

- Review Your Loan Terms: Before signing on the dotted line, review the loan terms carefully. Make sure you understand the APR, interest rate, loan term, monthly payments, and any fees associated with the loan.

Conclusion

Understanding what APR is and how it affects your car loan is essential for making an informed decision when buying a vehicle. By knowing the factors that influence APR and taking the right steps to secure the best rate, you can save money over the life of your loan.

At Raceway Motors, we’re committed to helping you find the best financing options with the most competitive APR. Visit our website to view our inventory, learn more about our current loan offers, and speak with one of our financing experts.